How Transaction Advisory Services can Save You Time, Stress, and Money.

Table of ContentsFacts About Transaction Advisory Services RevealedThe Main Principles Of Transaction Advisory Services Transaction Advisory Services - TruthsNot known Incorrect Statements About Transaction Advisory Services How Transaction Advisory Services can Save You Time, Stress, and Money.

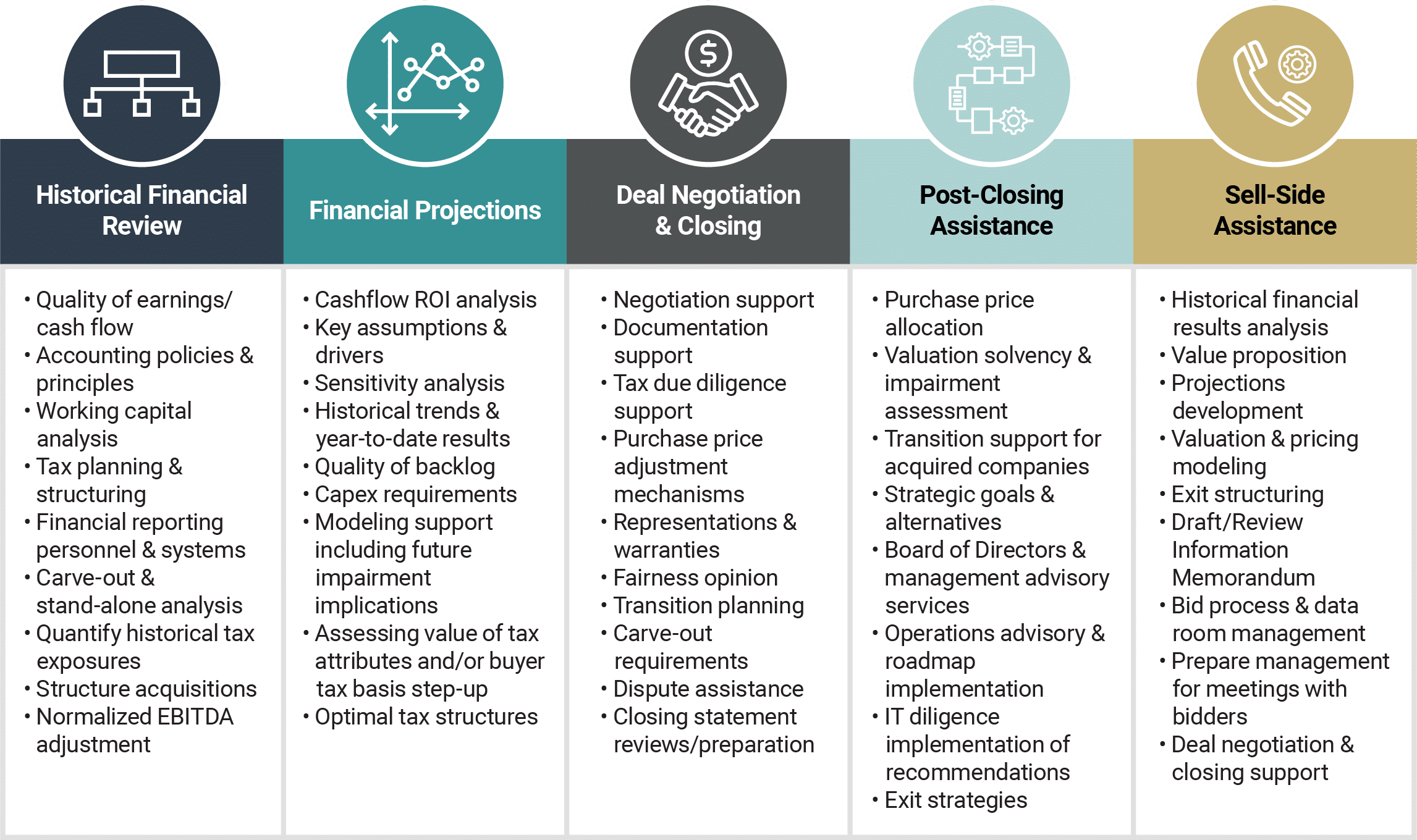

This step makes sure business looks its ideal to prospective customers. Obtaining the organization's worth right is essential for an effective sale. Advisors make use of various approaches, like discounted capital (DCF) analysis, comparing with similar companies, and recent transactions, to figure out the fair market price. This aids establish a reasonable cost and discuss successfully with future purchasers.Purchase advisors action in to assist by obtaining all the needed details organized, addressing inquiries from purchasers, and arranging visits to the organization's location. Purchase experts utilize their competence to help service proprietors deal with challenging negotiations, satisfy buyer expectations, and framework deals that match the proprietor's objectives.

Meeting lawful regulations is important in any kind of company sale. Purchase advisory services collaborate with lawful professionals to produce and assess contracts, agreements, and other lawful documents. This lowers risks and ensures the sale complies with the regulation. The role of transaction consultants prolongs past the sale. They aid local business owner in preparing for their following steps, whether it's retirement, beginning a brand-new endeavor, or handling their newly found wide range.

Transaction advisors bring a wealth of experience and knowledge, making sure that every element of the sale is managed skillfully. With calculated prep work, assessment, and arrangement, TAS aids company owner attain the greatest feasible sale price. By making sure legal and regulatory compliance and handling due persistance together with other bargain group members, transaction experts decrease prospective risks and liabilities.

A Biased View of Transaction Advisory Services

By comparison, Big 4 TS groups: Service (e.g., when a possible purchaser is conducting due persistance, or when a deal is shutting and the customer requires to integrate the firm and re-value the seller's Equilibrium Sheet). Are with fees that are not connected to the deal shutting successfully. Make fees per involvement somewhere in the, which is much less than what investment financial institutions earn also on "small offers" (yet the collection likelihood is likewise a lot higher).

, yet they'll focus extra on accounting and evaluation and less on topics like LBO modeling., and "accounting professional just" subjects like trial balances and exactly how to stroll via occasions using debits and credit reports instead than economic statement changes.

The 10-Second Trick For Transaction Advisory Services

Specialists in the TS/ FDD groups may additionally speak with administration about every little thing above, and they'll write a thorough report with their findings at the end of the procedure.

The pecking order in Transaction Providers varies a little bit from the ones in investment financial and personal equity professions, and the basic form looks like this: The entry-level function, where you do a great deal of information and monetary evaluation (2 years for a promotion from below). The following level up; comparable work, yet you get the even more fascinating bits (3 years for a promo).

Specifically, it's hard to get advertised beyond the Supervisor degree since couple of people leave the work at that stage, and you require to begin revealing evidence of your capacity to generate profits to advance. Let's begin with the hours and lifestyle given that those are easier to explain:. There are read more periodic late look at here evenings and weekend work, however absolutely nothing like the frantic nature of investment banking.

There are cost-of-living adjustments, so expect lower compensation if you're in a less expensive place outside major monetary (Transaction Advisory Services). For all settings other than Companion, the base wage consists of the mass of the total compensation; the year-end perk may be a max of 30% of your base salary. Typically, the very best means to raise your revenues is to switch over to a various firm and work out for a higher wage and incentive

Excitement About Transaction Advisory Services

You can enter into business development, but investment banking obtains harder at this stage due to the fact that you'll be over-qualified for Expert duties. Corporate financing is still an option. At this phase, you ought to simply stay and make a run for a Partner-level duty. If you desire to leave, perhaps transfer to a client and execute their assessments and due diligence in-house.

The main trouble is that due to the fact that: You normally need to join an additional Big 4 team, such as audit, and job there for a few years and after that relocate into TS, work there for a couple of years and after that move into IB. And there's still no guarantee of winning this IB role since it relies on your region, clients, and the employing market at the time.

Longer-term, there is additionally some risk of and since assessing a company's historical monetary details is not exactly brain surgery. Yes, people will certainly constantly require to be involved, however with even more advanced innovation, reduced headcounts might possibly support customer engagements. That stated, the Purchase Services group defeats audit in terms of pay, job, and leave opportunities.

If you liked this short article, you may be curious about reading.

How Transaction Advisory Services can Save You Time, Stress, and Money.

Create advanced financial frameworks that assist in establishing the actual market value of a company. Offer advisory operate in This Site connection to company valuation to assist in bargaining and prices structures. Explain one of the most suitable kind of the deal and the sort of consideration to use (cash money, stock, make out, and others).

Develop action prepare for risk and exposure that have actually been identified. Carry out assimilation planning to figure out the procedure, system, and organizational modifications that might be called for after the deal. Make numerical price quotes of combination expenses and advantages to assess the economic rationale of combination. Establish standards for integrating departments, innovations, and organization processes.

Recognize possible decreases by reducing DPO, DIO, and DSO. Evaluate the potential client base, market verticals, and sales cycle. Think about the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due persistance uses essential understandings right into the functioning of the firm to be acquired worrying risk assessment and value creation. Identify temporary adjustments to financial resources, banks, and systems.